Ready for Lift-Off: The Booming SpaceTech Industry in Germany and Europe

🚀 How European investors are fueling a new era of space exploration and technology.

The SpaceTech sector is experiencing rapid growth, driven by groundbreaking innovations and visionary entrepreneurship. In this deep dive, we’ll explore the perspectives of European investors, the structure of funding rounds, and analyze potential risks within SpaceTech. Additionally, we’ll highlight the key forces and opportunities shaping this exciting and emerging industry.

🛰️ Rocket Science? — SpaceTech in a Nutshell

A brief overview of SpaceTech and its upstream and downstream sectors.

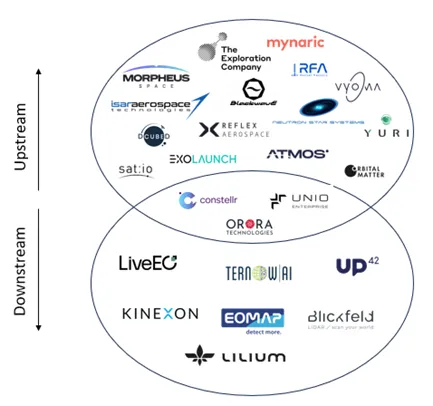

SpaceTech encompasses the cutting-edge technologies and applications that push the boundaries of space exploration, creating new opportunities for scientific discovery, economic activity, and human advancement. The sector can be divided into two primary categories: Upstream and Downstream.

- Upstream SpaceTech refers to technologies that focus on space transport, exploration, and research. This includes rockets, satellites, space probes, and other spacecraft that are designed to gather data and explore the universe. It also involves companies that participate in space missions or conduct biotech experiments in space to test their technology in unique conditions.

- Downstream SpaceTech involves the use of space-based technologies and data for applications here on Earth. This includes satellite data for Earth observation, telecommunications, weather forecasting, and navigation, laying the foundation for precise information and innovative services derived from space technologies.

Here’s a glimpse of some prominent German SpaceTech companies along the value chain:

🌍 Ground Control — The European Investor’s Perspective

How European investors are backing the SpaceTech sector.

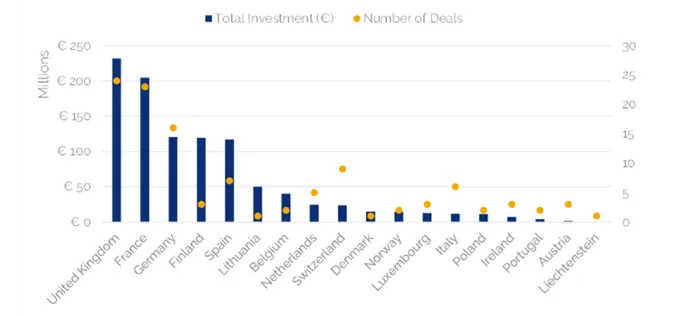

Every year, the European Space Policy Institute (ESPI) releases its Space Venture Europe report, highlighting trends in entrepreneurship and private investment in SpaceTech. The 2022 report revealed remarkable growth: European space startups attracted a record €1.1 billion in investments, a 23% increase from the previous year. Finnish company Iceye, for instance, secured €120 million, the largest funding round of the year, to expand its satellite constellation and strengthen its disaster management and analytics services.

In contrast to the global slowdown in space funding, Europe remains bullish on SpaceTech. Globally, €8.8 billion (-28%) was raised in 2022, with venture capital still the dominant form of investment (55%).

Germany, ranked third in Europe, solidified its position as a leader in SpaceTech innovation. In 2022 alone, German startups secured €120 million across 16 deals, a 48% increase from the previous year.

According to the European Deep-Tech Report 2023 from Dealroom, investments in SpaceTech are not only growing in volume but also in the size of funding rounds. Deals between €90 million and €230 million made up over one-third of all capital raised in 2022, excluding mega-rounds like OneWeb. According to Dealrooms Space-Tech Report interest has been particularly strong in rocket development and Earth observation satellites, with German companies like Isar Aerospace (launch vehicle development) and Constellr (Earth observation sensors) leading the charge.

🧭 Orbital Maneuvering — Obstacles to Overcome

Challenges that SpaceTech companies must navigate to thrive.

The SpaceTech industry faces significant hurdles, from high project costs to complex technological challenges, and even the growing issue of space debris. The European Space Agency (ESA) warns that increased space traffic is leading to more “close encounters” and a dwindling number of available orbits. Other risks include natural disasters, high insurance premiums, cybersecurity threats, and intricate legal frameworks.

As Clifford Chance outlines in their report on space industry risks:

“If we want to conduct mining in space, we’ll need to think about water and land rights, as well as the sourcing of raw materials. On Earth, we already have supply chain issues with rare earth elements, radiation-hardened processors, and space-grade photovoltaic cells. In space, these challenges become even more complex.” (Source)

Environmental impact and sustainability practices are also on the industry’s agenda. Addressing these challenges will require careful planning, innovation, and collaboration to unlock the full potential of SpaceTech.

🔧 Astrodynamics — Market Trends and Drivers

The trends shaping the future of SpaceTech.

Despite the risks, the opportunities in SpaceTech are immense. A range of innovative developments signal a promising future for the industry, including the miniaturization of satellites and the creation of satellite constellations for enhanced Earth observation.

SpaceTec Partners, in their research paper “New Business Models at the Interface of the Space Industry and Digital Economy”, emphasize the close integration between SpaceTech and existing IT infrastructure. Leveraging commercially available components from other sectors is more cost-effective than developing specialized technologies. The advanced Internet of Things (IoT) and autonomous vehicle technologies provide a foundation for promising space applications. Furthermore, modern software can utilize existing hardware while more powerful AI algorithms reduce satellite operation costs.

Additive manufacturing (3D printing) is speeding up development through agile prototyping, reducing weight, and lowering supplier risks. Resource exploration in space is also becoming a key focus, while global competition and increased collaboration between space agencies are driving positive trends across the sector.

📌 Summary of the Article

- The European SpaceTech sector is booming, with €1.1 billion raised in 2022, a 23% increase from the previous year.

- Germany is a key player, with €120 million raised across 16 deals in 2022.

- SpaceTech’s two main areas: Upstream (space exploration, satellites) and Downstream (Earth applications, data services).

- The industry faces challenges like space debris, high costs, and legal complexity, but innovations like satellite miniaturization and AI-driven cost reductions are opening new opportunities.

- DTCF supports both upstream and downstream SpaceTech companies, positioning itself as a vital part of the German SpaceTech ecosystem.

_____________________________________

As a growth investor and long-term partner for technology-driven, highly innovative companies, the DeepTech & Climate Fund (DTCF) is actively involved in the German SpaceTech ecosystem. Given the long development cycles and significant capital needs of hardware-heavy operations, the fund’s structure is designed to meet the unique requirements of upstream companies. With strong expertise in software and data management, DTCF also provides active support to downstream SpaceTech founders.

Want to learn more about SpaceTech investment opportunities or pitch your ideas? The DTCF team is eager to hear from visionary founders and investors who are ready to shape the future—on Earth and beyond! 🌍✨ Let’s build the next generation of space innovations together!

👉 This article was written by Lena Stache.