Deep Dives

The Rise of Alternative Proteins in DACH & Europe

🌱 The future of food is plant-based, fermented, and cultivated! As alternative proteins gain traction, they promise a greener, more sustainable food system. But despite their potential, challenges remain. This deep dive provides an overview of innovative startups in the DACH region, various technologies, and the current state of European financing for alternative proteins.

⏳ The Future of Alternative Proteins

The transformation of the global food system is crucial to achieving our climate goals and ensuring food security for a growing world population. Particularly, the reduced land use and significantly lower greenhouse gas emissions make the production of alternative proteins especially attractive. This market offers vast opportunities for innovation and is projected to replace one out of every ten portions of animal-based products by 2035.

However, despite these promising prospects, many investments have yet to deliver the desired returns. Reports of bankruptcies, declining sales, and sharp drops in valuations are becoming more common. Experts attribute this mainly to the taste, health aspects, and price of these products, which result in low consumer acceptance. Moreover, there are movements in politics that aim to completely ban research and production of cultivated meat products.

On the other hand, there are also positive developments that provide cautious optimism. In the U.S., Singapore, and Israel, the first approvals for cultivated meat have been granted. Products are becoming cheaper and better. The first cultivated burger cost $250,000 to produce, while today, people in Singapore can already enjoy cultivated chicken for around €13 (07/2023).

Governments in Japan (01/2024) and Denmark (10/2023) are launching funding programs, viewing this sector as essential to their climate policies. Recently, the German government also announced a €38 million funding initiative (11/2023).

Higher-quality products, which impress in terms of price, sensory properties, and ingredients, are expected to mark the next wave of market success. As Europe’s largest market for plant-based alternatives, Germany offers enormous opportunities for startups in the alternative protein space.

Source: Good Food Institute (GFI) & DTCF research, Summer 2024

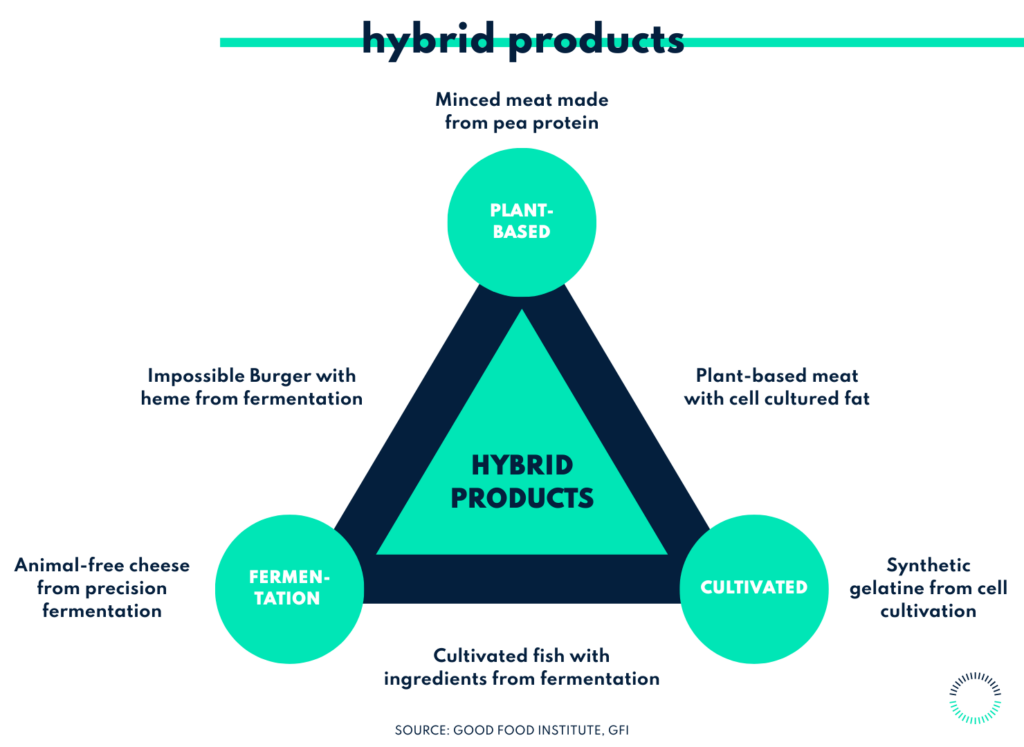

🗺️ Alternative Proteins: Alternative proteins encompass a broad range of food innovations that replace conventional meat and other animal products such as milk or cheese. These include plant-based alternatives, proteins from fermentation, and products derived from animal cell cultures. Additionally, these technologies can be combined to create hybrid products, for example, a combination of cultivated cells and plant-based proteins.

🌱 Plant-Based Proteins

This category includes products made directly from plants like peas, soy, or wheat, aiming to replicate the sensory experience of their animal-based counterparts. Pioneers like Beyond Meat and Oatly have popularized this sector and shaped the first wave of alternative proteins. While plant-based milk alternatives have reached the mainstream, there’s still room for growth in the plant-based meat category. Critical factors such as sensory properties (taste and texture), the length of the ingredient list, and product pricing are key drivers of consumer acceptance.

In the DACH region, there is a wide range of both new and established companies shaping the market. Startups like Planted and vly are noteworthy, as well as established food companies such as Infamily Foods with their Billie Green brand or Rügenwalder Mühle.

🦠 Fermentation-Based Proteins

Fermentation is a broad term covering several processes that use microorganisms to create functional ingredients. This age-old craft was once primarily used to preserve food, produce alcoholic beverages, and enhance the nutritional value of food. It can be divided into three main categories: traditional fermentation, biomass fermentation, and precision fermentation:

- Traditional fermentation has been used for centuries to create foods like cheese, yogurt, or beer. This method leads to products with unique flavor and nutrient profiles as well as altered texture. Fermentation is also being explored for plant-based protein alternatives, such as Tempeh—a product made from soybeans inoculated with fungi—and various meat substitutes like Planted’s new steak.

- Biomass fermentation leverages the rapid growth and high protein content of certain microorganisms to efficiently produce large quantities of protein. Microbial biomass can be used as an ingredient, either intact or minimally processed. Many companies are also working on using mycelium or microalgae for fermentation. Notable startups in this space include Infinite Roots and MicroHarvest.

- Precision fermentation uses microbial hosts as „cell factories“ to produce functional ingredients. In this process, microorganisms are biochemically programmed to produce specific ingredients. These ingredients can enhance the sensory properties and functional attributes of plant-based products or cultivated meat. Examples include Formo or Fermify producing casein, or Clara Foods and onego.bio focusing on egg proteins.

🧬 Cell-Based Proteins

This sector involves ingredients cultivated directly from animal cells without the need to raise or slaughter animals. While still in its early stages, it holds the promise of drastically reducing emissions and land use compared to traditional meat production.

The process starts with taking a small sample of cells from a living animal, which are then cultivated in a bioreactor under optimal conditions. With the addition of nutrients and the creation of a suitable environment, the cells divide and grow into muscle and fat tissue, resembling traditional meat in taste, texture, and nutritional content. Further information is available from organizations such as the Good Food Institute (GFI).

First presented by Dutch scientist Prof. Mark Post in 2013, this concept has evolved significantly over the last decade, with the first products now approved in Singapore and the U.S. Companies like Upside Foods are already selling their products in the foodservice industry, and recently, Eat Just has made its cultivated chicken available in supermarkets in Singapore. In the DACH region, competitors include Bluu Seafood with their cultivated fish and Myria Meat, focusing on cultivated pork.

⛏ Infrastructure („Picks and Shovels“)

The shift to alternative proteins creates opportunities for potential investments in supporting infrastructure, which will help achieve price parity and sensory improvement. For instance, companies working in fermentation and cell cultivation need bioreactors to produce their products. Nutrient media for stem cell growth are also a critical and costly factor. Functional ingredients from fermentation could provide solutions here. For a deeper look into infrastructure investments, check out the article by Christian Gupta and Nicolaus Norden (03/2023) from FoodLabs.

Source: Good Food Institute (GFI)

💸 Europe as a Global Bright Spot

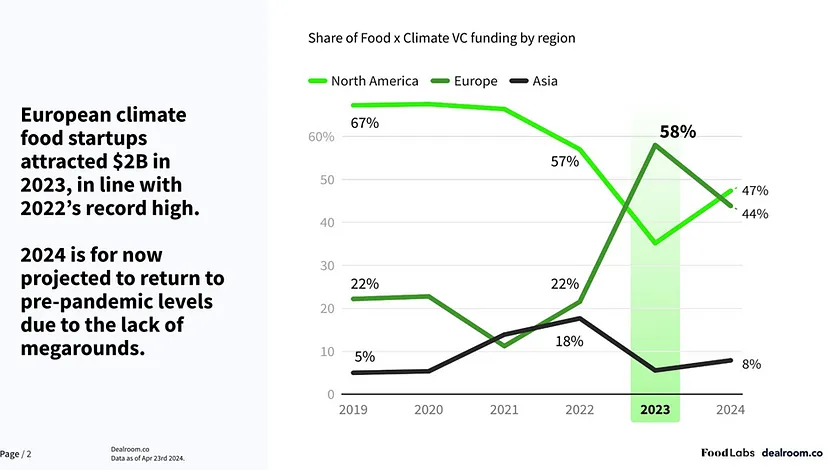

According to a recent article by FoodLabs & Dealroom, European investors continue to value the FoodTech space, particularly focusing on AgTech and alternative proteins. In 2023, Europe accounted for more than half of the global financing for climate-focused FoodTech companies, surpassing the U.S. for the first time.

Source: FoodLabs x Dealroom

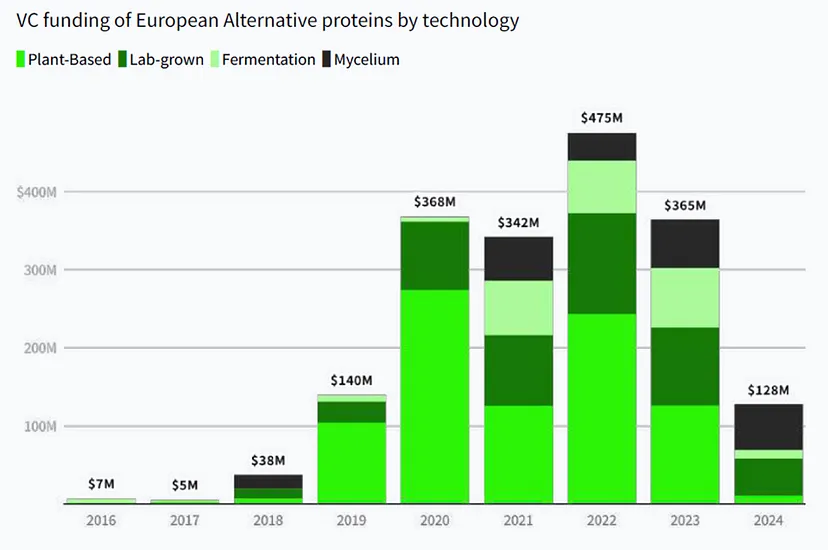

The analysis shows that investments in the field of alternative proteins are currently at the same level as in 2019. A trend towards investments in cultured & fermented proteins continues to emerge.

Source: FoodLabs & Dealroom

Notable deals in the DACH region over the past 12 months include Infinite Roots (€53M), Planet A Foods (€15M), Protein Distillery (€15M), Cultivated Biosciences (€5M), and Cultimate (€3M). Further growth rounds are expected in 2024, which will continue to strengthen the European market.

📌 Summary of the Article

- Alternative proteins (plant-based, fermentation-based, and cell-based) offer solutions for reducing emissions and land use while providing new food options.

- While plant-based proteins have achieved some market penetration, there’s significant room for improvement, especially in taste, health benefits, and price.

- Fermentation-based proteins (traditional, biomass, precision fermentation) are gaining traction, with promising developments in ingredients and production.

- Cell-based proteins, though still emerging, are gradually moving toward affordability and availability, with approvals in markets like Singapore and the U.S.

- European investment in FoodTech is surpassing the U.S., and DACH region startups are seeing growing support.

- A lot of promise lies in improving infrastructure („picks and shovels“) to help achieve price parity and improve sensory qualities of alternative proteins.

_____________________________________

The DeepTech & Climate Fonds (DTCF) sees itself as an active part of the FoodTech ecosystem, closely linked to the adjacent AgTech sector. With our fund volume of up to €1 billion, we are not afraid of capital-intensive investments. We are interested in early growth rounds and look forward to engaging with startups and investors who are actively working to transform the food system

Are you an entrepreneur in the alternative protein space? Have any suggestions, or know of companies we might have overlooked? We would love to hear from you and welcome your messages, suggestions, and feedback.

👉 This article was written by Luca Fischer.